The Power of Volatility: How Diversification and Automation Transform Portfolio Performance

Volatility as an Opportunity

Today, I want to share something remarkable with you. Some of our trading strategies are specifically built to thrive in volatility. Volatility creates more distinct opportunities for entry and exit—the bread and butter of compounding returns, and compounding returns are the holy grail of investing. In volatile markets, prices move more rapidly and unpredictably, allowing for frequent and profitable trading opportunities that help to accelerate compounding returns.

With this in mind, we spent months developing strategies that automate trading for highly volatile instruments (stocks, ETFs, etc.). These strategies performed exceptionally well in backtesting and forward testing—so well, in fact, that we hesitated sharing the results for fear of being perceived as overly optimistic. And yes, you can’t allocate more than $20-50 million to this strategy portfolio before things start to deteriorate, but that’s the beauty of not being a gigantic hedge-fund with a few billion of AUM.

Still, I do want to demonstrate the magic of diversification. I already wrote about the benefits of diversification in this post on ‘Portfolio Optimization with Low-Correlation Subpar Sharpe Ratio Strategies‘. I know it’s quite a mouthful.

The Magic of Diversification

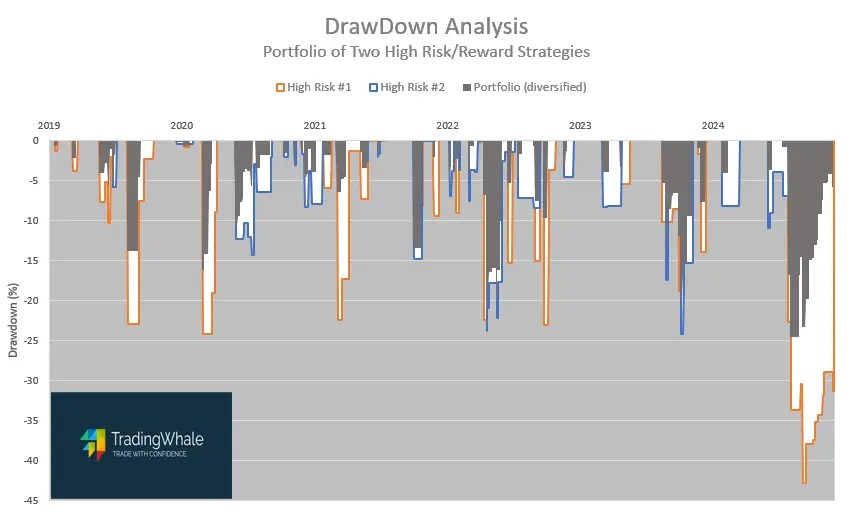

The chart below shows the drawdown analysis (Jan 1, 2019 to Nov 28, 2024) for two high-risk/return strategies (blue and orange lines) and the combined effect if both run together in a portfolio (dark gray area). The white areas represent how diversification works its magic—offsetting each strategy’s drawdowns. Towards the right, a big 40%+ drawdown in one strategy (orange) was offset by a gain in the other strategy (blue), resulting in a reduced 25% dip for the diversified portfolio. Sure, 25% is significant when you talk about real money. However, you can clearly see the power of diversification reducing the impact, and the portfolio drawdown is already back to 5%. Overall, portfolio drawdown spikes were reduced from around 25% to below 15% for the majority of the trading range, which helps manage risk while allowing for continued growth. Keep in mind that we used only two high-risk/reward strategies here. The more low-correlated strategies you add, the better your portfolio risk profile becomes.

Now that we saw what diversification can do, let’s take a look if all that risk, though reduced, is even worth your time.

Are High-Risk/Reward Strategies Worth It?

Despite these strategies’ high drawdowns, they shine in recovery. In our next two charts, we’ll look at the percentage gains of each strategy and the combined portfolio gain—first at a regular scale to better see the right side, and then in log scale to better see the left side. The individual strategies here have sharp moves. However, when combined, they create much more stable overall growth, resulting in a smoother equity curve and reduced drawdowns. Now imagine building a portfolio with ten high-risk, high-reward strategies that actually have a low correlation—that’s where diversification truly becomes powerful. It makes you look at risk-reward differently.

Real-World Considerations: Capacity and Slippage

- While our strategies above deliver impressive backtested results, real-world constraints like capacity and slippage can limit scalability. As portfolio size grows, executing large trades becomes increasingly difficult without affecting market prices, depending on the average daily volume of what you’re trading. But you don’t need to pursue 1 million % gains. As my ‘super happy line’ indicates (see the green line on the charts above), I would have been thrilled with 50,000% growth in four years.

- Also, as far as volatility-targeting strategies go, these two got very lucky as 2020, 2022, and 2023 saw their fair share of volatility. The strategies, and the portfolio would have been significantly less successful in a calmer time. Low-volatility conditions reduce the number of rapid price movements, which limits trading opportunities and the potential for compounding returns.

Stress-Testing the Strategies

To ensure robustness, we stress-tested our high-risk algorithms by pushing their parameters to the limit. Even after simplifying them to rely solely on our proprietary Omega signal indicator and ATR for risk management, the strategies maintained impressive performance. Even in this minimal configuration, both strategies outperformed their underlying assets by significant multiples. This reinforces our belief that the core to their success lies in the robust and reliable signals generated by the Omega algorithm.

Conclusion: A Balanced Approach

The lesson here isn’t about chasing massive returns with risky one-off bets. Instead, it’s about consistent automation and finding the right balance. High-risk/reward strategies that focus on harnessing the power of volatility can offer exciting potential, but the real power comes from diversifying multiple of them in an automated portfolio of similar trading strategies and in combination with lower-risk assets.

Volatility and automation help harness the compounding effect over time. By smoothing returns and managing risk, a well-diversified long/short portfolio can consistently grow, even in unpredictable market conditions. The Long/Short SPY strategy, with its focus on steady growth and risk management, complements high-risk strategies by providing a solid foundation that leverages the compounding effect for long-term success.

Ready to rethink your portfolio? Start by exploring how a balanced and automated trading approach can bring stability and compounding growth to your investments.