Drawdown in Trading: A Complete Guide

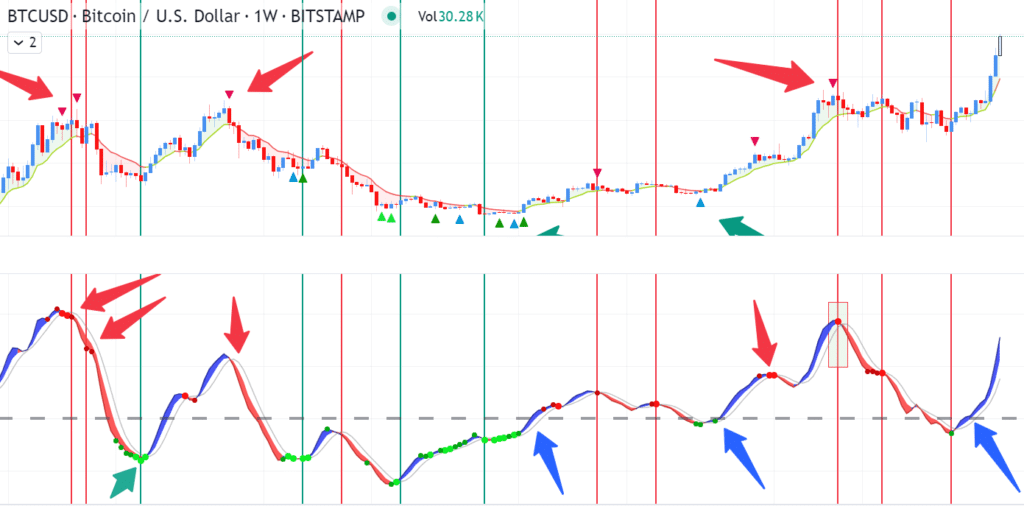

In the realm of trading, drawdown is a critical metric that quantifies the decline in an investment’s value from its peak to its subsequent trough. This measure is pivotal for traders and investors, as it provides insight into the potential risks and volatility associated with a particular trading strategy or portfolio. The chart above shows the performance […]

Drawdown in Trading: A Complete Guide Read More »