Comprehensive Risk-Adjusted Portfolio Efficiency (CRPE): An Overdue Upgrade in Portfolio Evaluation

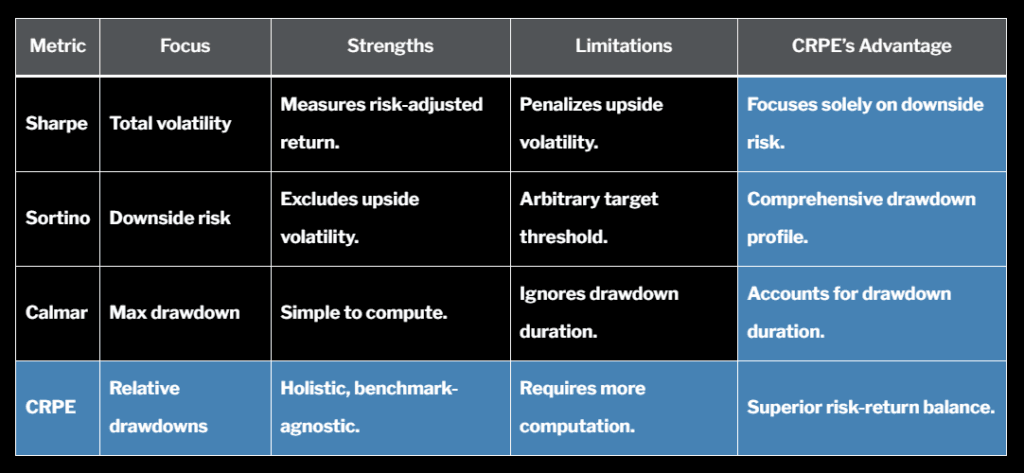

Abstract The Comprehensive Risk-Adjusted Portfolio Efficiency (CRPE) metric is introduced as a new approach to evaluating trading strategies based on risk-adjusted performance. Traditional metrics like the Sharpe Ratio, Sortino Ratio, and Calmar Ratio focus on different aspects of return versus risk but often rely on single-point values, which fail to capture the nuanced behavior of […]