Introducing CRPE: The Future of Risk-Adjusted Portfolio and Trading Strategy Evaluation

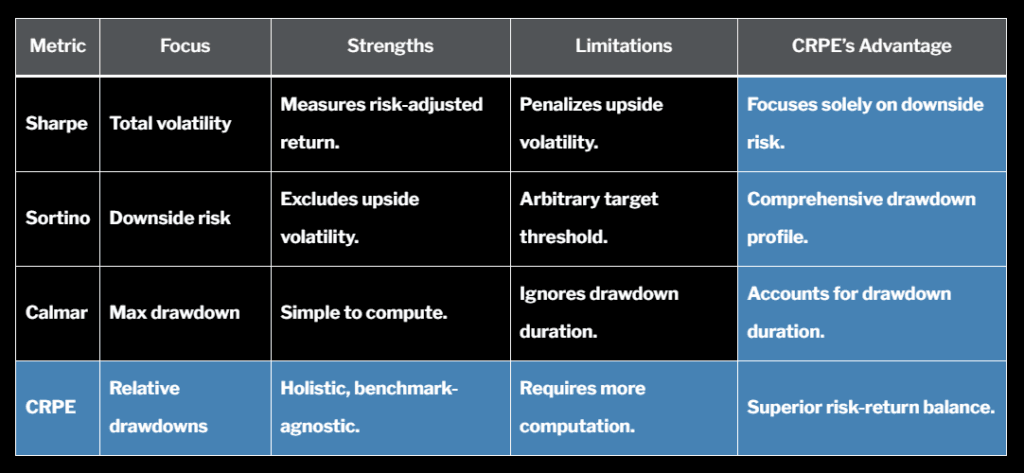

TL;DR: CRPE – A Smarter Portfolio Evaluation Metric The Comprehensive Risk-Adjusted Portfolio Efficiency (CRPE) metric redefines portfolio evaluation. Unlike Sharpe or Sortino, it analyzes full drawdown profiles, enabling better comparisons across portfolios or strategies, even with different benchmarks. CRPE rewards strong returns with effective risk management—perfect for smarter, modern investing decisions. The longer version When […]

Introducing CRPE: The Future of Risk-Adjusted Portfolio and Trading Strategy Evaluation Read More »